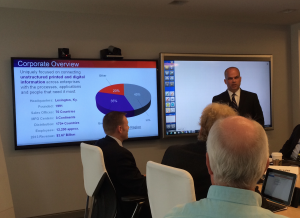

This week I was in New York City attending the Lexmark analyst event held at their newly opened offices. The facilities are modern looking, equipped with conferencing capabilities exhibited when Marty Canning, President of Lexmark, “joined” us for a bit to chat about their goals and vision.

This new office is part of an updating process they’re going through. The Toronto offices were recently renovated and their Lexington facilities are in the midst of a $6 million overhaul.

[Tweet “Lexmark is all about Solutions”]

Believe it or not, Lexmark is approaching their 10th anniversary in this channel and based on the list of prestigious dealers marketing their products, they’ve been pretty successful. Lexmark execs made it clear that they are no longer satisfied as the 2nd or 3rd brand; they want to go deeper with dealers.

How will they do this? Through solutions. NA VP Mike Johnson told us that Lexmark’s goal is that 50% of their revenue will come from solutions by 2017. This isn’t something they’re backing into, it’s been a methodical process that began in 2010 when they made the first of their 11 “recent” acquisitions.

How will they do this? Through solutions. NA VP Mike Johnson told us that Lexmark’s goal is that 50% of their revenue will come from solutions by 2017. This isn’t something they’re backing into, it’s been a methodical process that began in 2010 when they made the first of their 11 “recent” acquisitions.

Lexmark did a great job signing up dealers over the last several years, a seemingly easy task for a company that had a strong A4 offering that was far superior to that of traditional A3 manufacturers. While most A3 vendors seemed to almost purposely drag their feet in developing cohesive A4 portfolios, that’s the core of Lexmark’s portfolio. Today the Business Solutions Dealer (BSD) channel is Lexmark’s number one channel in both revenue and growth. That channel has seen SMB hardware units up 26% and hardware revenue up 17% since the BSD launch. Not bad in a “flat” market don’t you think?

Lexmark did a great job signing up dealers over the last several years, a seemingly easy task for a company that had a strong A4 offering that was far superior to that of traditional A3 manufacturers. While most A3 vendors seemed to almost purposely drag their feet in developing cohesive A4 portfolios, that’s the core of Lexmark’s portfolio. Today the Business Solutions Dealer (BSD) channel is Lexmark’s number one channel in both revenue and growth. That channel has seen SMB hardware units up 26% and hardware revenue up 17% since the BSD launch. Not bad in a “flat” market don’t you think?

Now Lexmark aims to take it to the next level with an increased focus on solutions. While most vendors have developed partnerships with solutions companies, Lexmark has chosen a different path, developing their own solutions, both in-house or through acquisitions.

There are pros and cons of both approaches. Partnering with recognized and well-known best of class solutions companies can make for a compelling portfolio. However, from a support standpoint, customers will surely like the “one throat to choke” relationship they have with Lexmark resellers. Keeping everything under one roof so to speak has its advantages. During Marty Canning’s part of the conference he told us that solutions “offers the opportunity to create differentiation.” In a world where all copiers and printers are seemingly the same, that may become increasingly important. What makes you different?

There are pros and cons of both approaches. Partnering with recognized and well-known best of class solutions companies can make for a compelling portfolio. However, from a support standpoint, customers will surely like the “one throat to choke” relationship they have with Lexmark resellers. Keeping everything under one roof so to speak has its advantages. During Marty Canning’s part of the conference he told us that solutions “offers the opportunity to create differentiation.” In a world where all copiers and printers are seemingly the same, that may become increasingly important. What makes you different?

There was a great deal of discussion around selling value instead of price. This is nothing new; most of you reading this have been trying to do that for years. To Lexmark’s credit, solutions do offer opportunities to lock in accounts. Lexmark mentioned they have a nearly 100% renewal rate (globally) with MPS customers and we all should know by now that anytime you can bundle solutions into a deal, the margins are better and the account becomes sticky. It’s one thing to refresh a fleet of hardware but when they’re tied to workflow and software investments, it’s not so easy to replace them.

[Tweet “40% of the top US k-12 School Districts use Lexmark”]

I know you’re thinking, “OK, so everyone has solutions. What makes this any different?” The somewhat unique approach of keeping most solutions development in-house is different than most. The only downside of that in my opinion is that many 3rd party solutions companies often have some advantages; such as they tend to work with most, if not all brands. They’re also recognized brands. Lexmark does offer partnerships with 3rd party solutions companies as well but the core of their offering is based on their own customized offerings. Key word “customized.”

Lexmark does have a presence with customers, especially the top tier in many vertical markets. According to Lexmark:

- 30% of the top US Healthcare systems use them

- 40% of the top US k-12 School Districts use them

- 70% of the top Federal Agencies use them

- 90% of the top global Retailers use them

- 36% of the top Fortune 50 Companies use them

- 70% of the top US and global Banks use them

Lexmark wants to build on the success they’ve experienced with the above types of customers and bring that approach down to the SMB market. They’ll do this by equipping and educating dealers and more importantly, their reps. Lexmark showed us a drag and drop solutions development program called Solution Composer. While this has been around for a few years, new modules and more interest from customers should make this tool very popular with dealers going forward. It seemed wicked easy to use.

[Tweet “30% of the top US Healthcare systems use Lexmark”]

Lexmark also announced a sales App at their last dealer show that puts critical information in the pocket of every sales rep that has a smart phone or tablet. Brochures, success stories, product information, videos to show customers and tons more are all at the sales reps’ fingertips. Apps like this are a great way for reps to understand exactly what they have in their pitch book and how to sell it. It also ensures the rep uses consistent messaging designed at the highest levels. We have been talking to most of the manufacturers for years about helping them develop apps just like this and to my knowledge, only Lexmark finally pulled something together.

Educating the sales rep and dealers about solutions and the potential they offer is paramount. Yes selling solutions can extend the sales process and I understand you have a full warehouse you need to clear out before each month ends. Lexmark had no shortage of success stories showing not only the hardware revenue dealers were earning as a direct result of selling a solutions, but there was often a large software revenue piece of the deal as well. Consider the dealer (I can’t tell you who they are but you all know them) that sold their largest deal ever – A3 or A4. The deal was for almost $400k, with about $100k in solutions revenue. Had they not pitched the solution, they would not have won the deal.

[Tweet “90% of the top global Retailers use Lexmark”]

This approach isn’t new; manufacturers have been preaching the importance of solutions for years. But seeing it in black and white makes you realize the opportunity. Instead of waiting for leases to expire, solutions offer you a reason to go talk to your customers way before they’re ready to consider hardware investments.

If you can improve their workflow and show an ROI, the customer won’t be so focused on when their lease expires. You have to admit, it’s a great reason to stay close to your customer and as a consultant, your role is not to go sell them the new 40 PPM machine, your goal is to help the customer leverage the technology they have and will have going forward.

There’s not much negative I can say. Lexmark has clearly listened to dealers in setting up this program. It’s grown nicely over the years; they’ve signed great dealers. The market shift from A3 to A4 that we’ve been experiencing has helped them gain traction. The push towards solutions offers great opportunity.

I don’t know if they can truly become a dealer’s #1 brand in the near future but down the road? Why not? Could a POA or Gordon Flesch stop selling their primary brand and live only on Lexmark? Probably not at this point. The reps are too entrenched in A3 and while Lexmark did tell me, “we have A3,” it’s not the same level of product as traditional copiers. The question remains, do customers really need A3? Personally, I don’t think so. A 60-PPM mono A4 MFP with a modest finisher will be suitable for probably 95% of customers, if not more.

[Tweet “70% of the top US and global Banks use Lexmark”]

The issue most dealers will have in transitioning full time to a mostly A4 portfolio is that they don’t think they can pay their sales force on A4. We can theoretically agree that if reps sold solutions and A4 they could potentially make a lot of money. However, not all reps are capable of selling sophisticated solutions and let’s face it, dealers are still making gobs of money on A3 at the moment and until they’re not, most will not to push their reps away from A3 to sell A4 and solutions. It all comes down to comp plan.

There are a very small number of dealers (Jeff Gau, Marco) that have adjusted comp plans to make sure reps are really selling solutions. Most dealers have not meddled with compensation and I would bet nearly all of you have almost the same hardware based comp plan you had 30 years ago. Until dealers figure out how to pay their reps to sell solutions, they won’t.

In any case, nice job with your event Lexmark and thank you for having me. I like the path you’re going down, I like the message and the simplicity of the programs. The support you’re putting together not only for the dealers but also for the sales reps is unique in my opinion. The move to solutions is a natural evolution and your strategy to take this approach from the Enterprise and bring it down to SMB will make dealers a lot of money…if they sell it.