PALO ALTO, CA – (GlobeNewswire) – May 27, 2020 – HP (NYSE: HPQ)

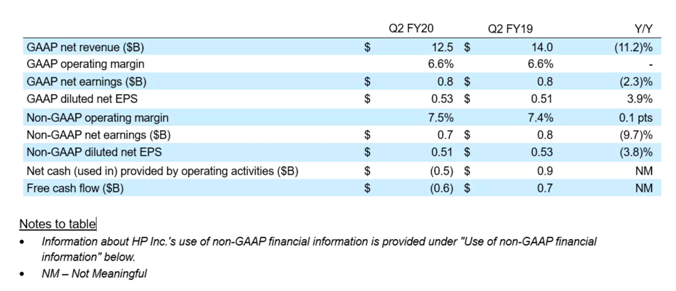

Second quarter GAAP diluted net earnings per share (“EPS”) of $0.53, above the previously provided outlook of $0.46 to $0.50 per share

HP Inc. fiscal 2020 second quarter financial performance

HP Inc. fiscal 2020 second quarter financial performance

The COVID-19 pandemic has created unprecedented global health and economic challenges. From the start of this crisis, HP’s number one priority has been the health and well-being of our employees. At the same time, we have marshalled our technology and resources to help address urgent needs in our communities.

HP and its partners have to-date produced an estimated 2.3 million 3D printed parts for face shields, face masks, respirators, ventilators, and other items for distribution to hospitals.

We have leveraged the scale of our global supply chain to source and distribute face masks to medical facilities facing shortages.

We have launched a series of global education partnerships to make it easier for teachers and students to connect from a distance.

Together with the HP Foundation, we are donating millions of dollars in products and grants to support response and relief efforts.

We have also taken actions to protect the broader HP ecosystem, including a variety of relief initiatives to help our channel partners weather the operational and financial challenges they face.

Net revenue and EPS results

HP Inc. and its subsidiaries (“HP”) announced fiscal 2020 second quarter net revenue of $12.5 billion, down 11.2% (down 10.1% in constant currency) from the prior-year period.

Second quarter GAAP diluted net EPS was $0.53, up from $0.51 in the prior-year period and above the previously provided outlook of $0.46 to $0.50. Second quarter non-GAAP diluted net EPS was $0.51, down from $0.53 in the prior-year period and within the previously provided outlook of $0.49 to $0.53. Second quarter non-GAAP net earnings and non-GAAP diluted net EPS exclude after-tax adjustments of $23 million, or $0.02 per diluted share, related to restructuring and other charges, acquisition-related charges (credits), amortization of intangible assets, non-operating retirement-related (credits)/charges, and tax adjustments.

“The strength of HP’s diversified portfolio, go-to-market capabilities and balance sheet position us well to navigate macroeconomic challenges and drive long-term value creation,” said Enrique Lores, HP’s President and CEO. “We are seeing strong demand from our customers in notebook PC orders and Instant Ink subscriptions, as well as growing interest in 3D printing and digital manufacturing in key verticals such as healthcare. The current environment will be a catalyst for transformation and innovation across HP.”

Asset management

HP’s net cash used in operating activities in the second quarter of fiscal 2020 was $(0.5) billion. Accounts receivable ended the quarter at $5.1 billion, up 7-days quarter over quarter to 37 days. Inventory ended the quarter at $6.4 billion, up 19-days quarter over quarter to 57 days. Accounts payable ended the quarter at $14.2 billion, up 30 days quarter over quarter to 128 days.

HP generated $(0.6) billion of free cash flow in the second quarter. Free cash flow includes net cash used in operating activities of $(0.5) billion adjusted for net investment in leases of $51 million and net investment in property, plant & equipment of $146 million.

HP’s dividend payment of $0.1762 per share in the second quarter resulted in cash usage of $0.3 billion. HP also utilized $0.1 billion of cash during the quarter to repurchase approximately 5.6 million shares of common stock in the open market. HP exited the quarter with $4.1 billion in gross cash, which includes cash and cash equivalents.

Fiscal 2020 second quarter segment results

Personal Systems net revenue was down 7% year over year (down 6% in constant currency) with a 6.6% operating margin. Commercial net revenue decreased 7% and Consumer net revenue decreased 7%. Total units were down 5% with Notebooks units up 5% and Desktops units down 23%.

Printing net revenue was down 19% year over year (down 18% in constant currency) with a 13.2% operating margin. Total hardware units were down 23% with Commercial hardware units down 25% and Consumer hardware units down 22%. Supplies net revenue was down 15% (down 15% in constant currency).

Outlook

For the fiscal 2020 third quarter, HP estimates GAAP diluted net EPS to be in the range of $0.35 to $0.41 and non-GAAP diluted net EPS to be in the range of $0.39 to $0.45. Fiscal 2020 third quarter non-GAAP diluted net EPS estimates exclude $0.04 per diluted share, primarily related to restructuring and other charges, acquisition-related charges, defined benefit plan settlement charges, amortization of intangible assets, non-operating retirement-related (credits)/charges, tax adjustments and the related tax impact on these items.

For fiscal 2020, given the level of uncertainty around the duration of the pandemic, the timing and pace of economic recovery and the potential impact of a resurgence in cases, HP anticipates a much wider range of outcomes for the year. As a result, HP will not be providing an outlook for the fiscal year 2020.

More information on HP’s earnings, including additional financial analysis and an earnings overview presentation, is available on HP’s Investor Relations website at investor.hp.com.

HP’s FY20 Q2 earnings conference call is accessible via an audio webcast at www.hp.com/investor/2020Q2Webcast

Available in PDF format — including all tables

MEDIA CONTACTS

HP Media Relations

MediaRelations@hp.com

HP Inc. Investor Relations

InvestorRelations@hp.com

Disclaimer

© Copyright 2020 HP Development Company, L.P. The information contained herein is subject to change without notice. The only warranties for HP products and services are set forth in the express warranty statements accompanying such products and services. Nothing herein should be construed as constituting an additional warranty. HP shall not be liable for technical or editorial errors or omissions contained herein.

SOURCE HP