By Andy Slawetsky – Xerox is now three quarters into their first year as a standalone print manufacturer. After splitting off their services group ACS at the end of 2016, Xerox started this year with a clean slate and a renewed focus on print and imaging.

Xerox has not posted a strong quarter since I can remember and this latest one is yet another that Xerox will hope to forget as they push forward with the turnaround.

Indeed, there were very few pockets of good news this past quarter compared to the same quarter of a year ago and comparing the first 9 months to the previous 9 months in 2016 didn’t offer any better news.

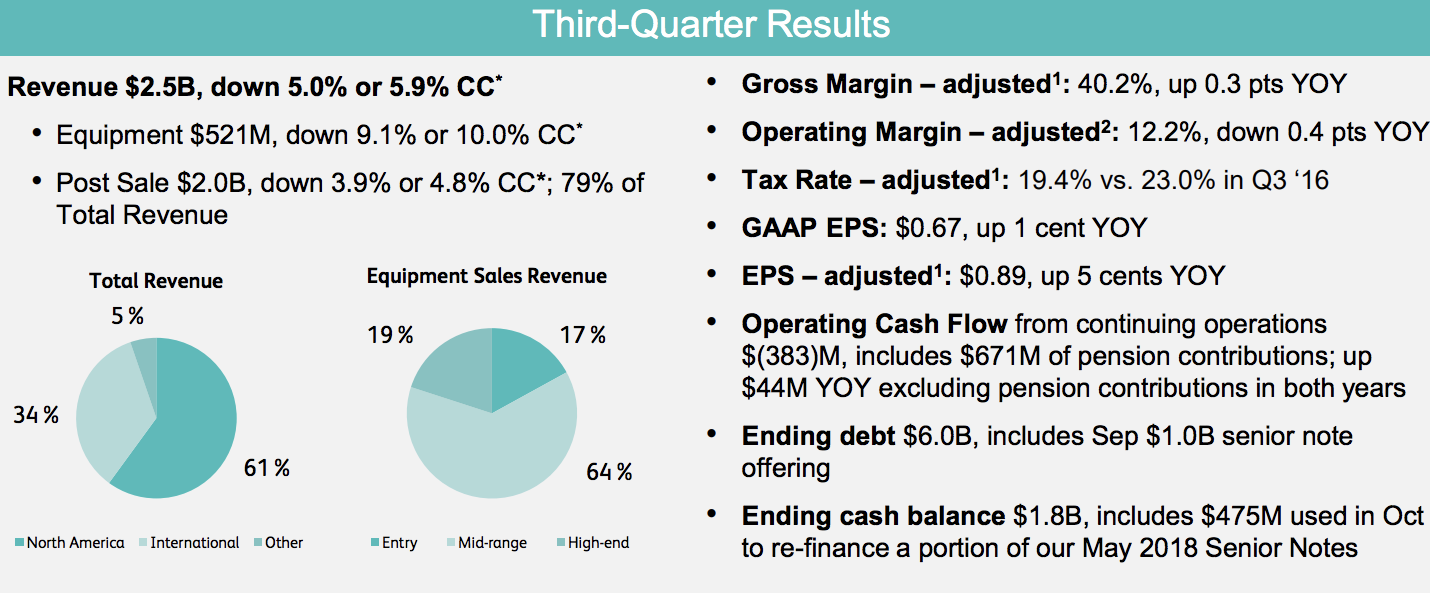

Here are some of the key metrics of Q3 2017 VS Q3 2016

| 2017 | 2016 | |

| Revenue | $981M | $1,057M |

| Services, Maintenance and Rentals | $1,442M | $1,489M |

| Equipment Sales | $521M | $573M |

| Post Sales Revenue | $1,976M | $2,056M |

| Managed Document Services | $853M | $835 |

| Entry Hardware | $86M | $97M |

| Mid-Range | $334M | $362 |

| High-end | $97M | $108M |

Managed Document Services was one of the few highlights, showing positive growth. Xerox also saw a 23% increase in color multifunction devices.

However, the 26% decrease in entry and 11% decrease in black and white MFPs continues to offset the color growth they’ve seen over the last few years. And the 32% decrease in high end black and white systems is an area of ongoing concern, especially with high end color being down slightly.

Nobody expected Xerox to turn things around quickly, but the progress indicated in the recent earnings suggests that it’s going to take much longer than people may have thought. As the “real” money comes from aftermarket, bad placement numbers now means that 3-5 years of service and supplies revenue won’t be coming.

Another area of concern is that Xerox cut R&D again; a dangerous proposition for a technology company. While they understandably need to cut costs to adjust to lower revenue, their future lays in the innovation that comes from their R&D and I’ve always said this should be the last thing a company in trouble should cut back on.

Last year, Xerox identified A4 as an area of great opportunity. This is actually an area of improvement for Xerox with A4 MFPs were up 23% YOY for color and 25% YOY for monochrome. It’s interesting to note that while A4 installs are up, revenue is still down for A4. Maybe they’re losing more on single function printers. Or, perhaps their A4 MFPs are selling for less than they used to, which would account for the increased unit sales but lower revenue.

Xerox’s transition to their dealer and GIS channels, among others, takes time. They’re still a formidable OEM and a leader in this industry. That said, the level of competition has never been stronger and Xerox appears to be having a difficult time pulling away from the pack. As the new strategies of the last 9 months continue to gain traction, Xerox should see these numbers begin to improve. However, at the moment, they are still struggling to increase revenue, which will impact their bottom line for years to come.

Click here to see the Xerox Earnings

Xerox Recognized for Innovative Approaches to Cyber Security