Xerox released their Q4 earnings this morning. Here are some of the highlights and low points in the numbers from what I can see:

Good

- Cost of sales down for quarter and year

- Expenses down for quarter and year

- Total costs down for quarter and year

- Entry level multifunction up YoY

- 11% increase in entry level color multifunction devices

- 9% increase in entry level monochrome multifunction devices

- 3% increase in mid range color installs

- 1% increase in mid range black and white

Bad

- Revenue down for quarter and year

- Financing down for the quarter and year

- Equipment sales down 9.5% for quarter

- Post sales revenue down 7.2% for quarter

- Service, maintenance and rentals down 9.2%

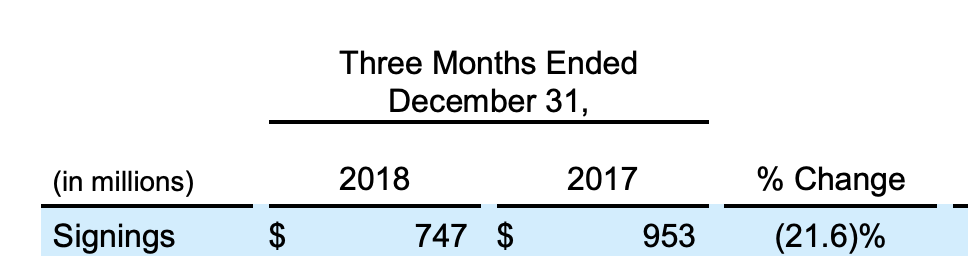

- Signings down 21.6% for Q4

- Signings down 12.8% for year

- 12% decrease in high-end color installs

- 34% decrease in high-end black and white systems

I like all the information Xerox is now providing. While some of it isn’t very flattering, they’re putting out there exactly what’s going on, more-so than in the past where some of the data became murky and hard to decipher in sensitive areas.

So here’s what I learned; Xerox is becoming more efficient and their cost cutting is working. They have pockets where they’re showing some improvement. However, fewer contract signings for the quarter and the year (one of the “new areas” I alluded to) is tough to shake off. The initial sale of the equipment generally only accounts for about 10% of the TCO over the next 5 years, meaning, the losses in hardware contracts now will result in future losses in revenue for the next 5 years.

Xerox is aggressively changing everything about themselves. They paired down the number of executives, cutting dozens over the last year. They’ve changed their distribution model, bringing GIS into the fold as a part of Xerox under the name XBS. As of this morning, they announced they are transitioning 28,000 accounts from Xerox to XBS, another significant change they’re undertaking.

Wall Street seems to love these moves, despite the current challenges Xerox is faced with – namely, stiff competition and a crowded playing field for starters. The bottom line is, they need to start winning deals again. After a year of turmoil, maybe some stability and positive news on earnings like today will settle customers down a bit and they’ll improve on that signings datapoint.

Click here to read the full release